If you’re facing issues with your QuickBooks Enterprise Desktop file, like the corruption of employee data or problems with direct deposit setup, you know how stressful and time-consuming it can be to try and resolve these issues. This is especially true when QuickBooks support isn’t able to provide a lasting solution, and you’re left trying to figure out how to move forward.

In this blog, I’ll walk you through the steps you can take when dealing with a corrupted QuickBooks Enterprise Desktop file, share how to manage multiple company files under the same EIN, and provide tips on setting up direct deposit in your new file.

What Happened to My QuickBooks File?

In 2023 and 2024, my QuickBooks Enterprise Desktop file started showing signs of corruption, primarily affecting employee data. Despite contacting QuickBooks support, we couldn’t get the corruption fixed. This left me with no choice but to manually create a new employee file, which came with its own set of challenges. Merging these files wasn’t an option, and dealing with year-end W-2s and tax reports became a headache.

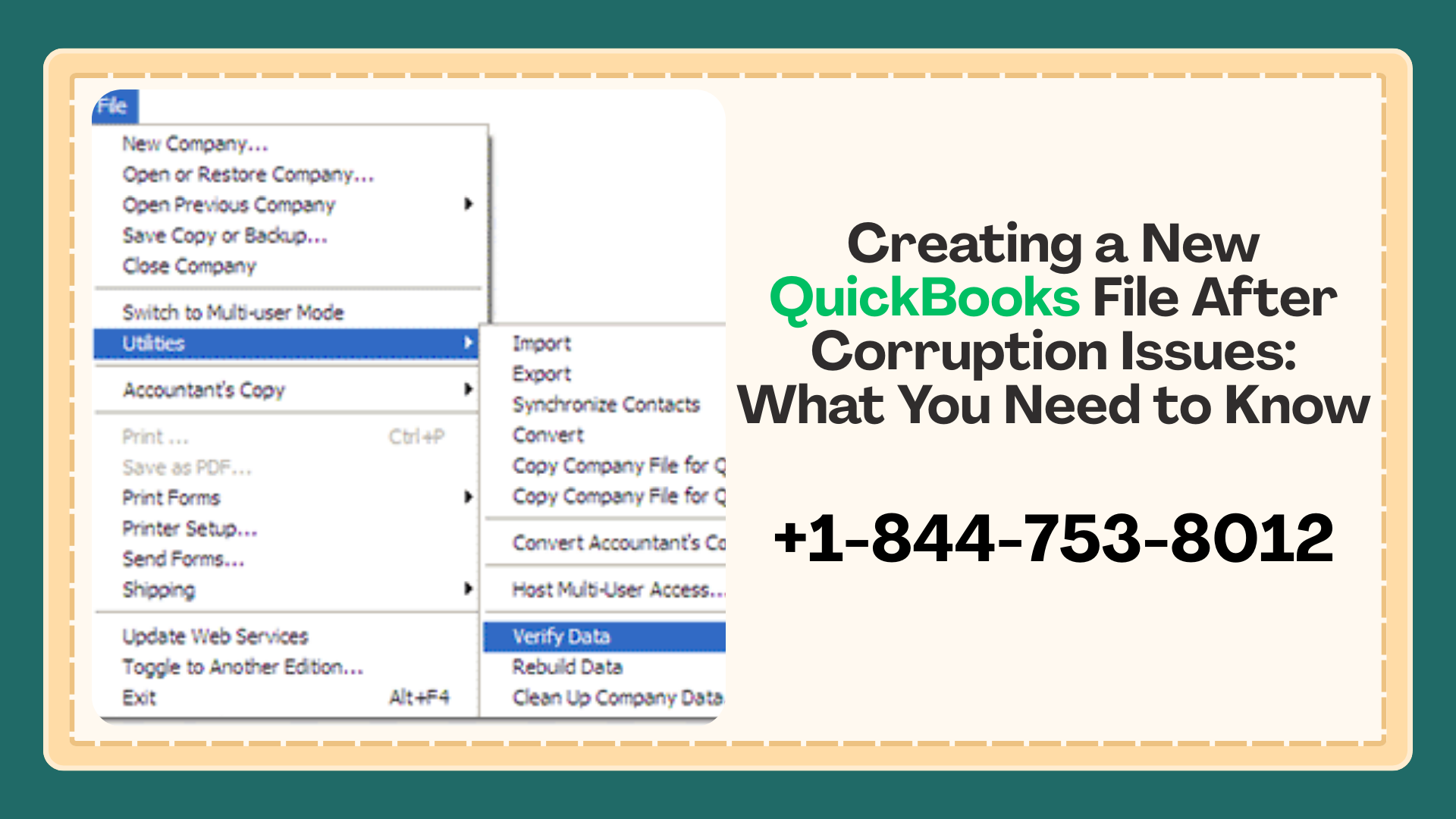

We tried to condense the file, thinking that might fix the problem, but that only led to more issues. Eventually, we determined that starting fresh was the best route. In September 2024, I decided to create a new QuickBooks file for 2025 and enter everything manually.

Creating a New QuickBooks File: Steps and Challenges

When I started setting up the new file for 2025, things seemed to be going smoothly at first. But when it came time to set up Direct Deposit for employee payments, the trouble started again. I went through numerous support technicians, but no solution was found. Despite all the efforts, I had no choice but to go back to the old file, which was increasingly showing signs of possible failure.

I found myself in a difficult position: the old file couldn’t be trusted for the upcoming year, and the new file wasn’t working properly for direct deposit. With the new year fast approaching, I had to figure out a way to fix things.

Can I Have Two Separate QuickBooks Files Under the Same EIN?

One solution I came across in my search for answers was the idea of having two separate QuickBooks files under the same EIN (Employer Identification Number). This might sound like an unusual approach, but it is a possible solution when your original file is corrupted or when issues like Direct Deposit setup are not working in a new file.

Here’s how it could work:

- File #1 (Original File): Continue using the old file for historical data, tax reports, and employee records that don’t need direct deposit functionality.

- File #2 (New File): Create a new company file for 2025 where you can set up Direct Deposit and continue normal payroll operations.

This method would allow you to separate the functions of each file while keeping everything under the same EIN for tax reporting and compliance.

Steps to Set Up a New QuickBooks File Under the Same EIN

If you decide to go the route of having two separate QuickBooks files, here’s how you can do it:

- Set Up the New File for 2025

- Start by creating a new company file for 2025 in QuickBooks Enterprise Desktop.

- Set up the bank account and payroll settings in this new file.

- Ensure that all payroll-related information, including employees and salaries, is set up correctly for the new year.

- Manually Enter Historical Data

- You’ll need to manually enter historical data (i.e., payments, transactions, employee hours) into the new file for 2025. This can be time-consuming, but it ensures that the new file is complete and up-to-date.

- Set Up Direct Deposit

- Now, you can try setting up Direct Deposit in the new file. If this was the issue with the old file, this fresh setup might resolve the problem.

- Backup Both Files Regularly

- Ensure that both files are backed up regularly. This way, if something goes wrong with either file, you’ll be able to restore it quickly.

- File #1 (Old File)

- Keep the old file for reference, tax reports, and historical data, but only use it for non-critical functions as it may be unreliable.

Why You Should Contact QuickBooks Support

Dealing with file corruption and payroll issues in QuickBooks Enterprise Desktop is frustrating, especially when support doesn’t seem to have a clear solution. If you’re in a similar situation and need expert assistance, don’t hesitate to call QuickBooks Support.

Phone number: 844-753-8012

QuickBooks professionals can help you with:

- Fixing file corruption issues

- Setting up direct deposit in new files

- Creating a more stable workflow for managing multiple files under the same EIN

Final Thoughts

Starting fresh with a new QuickBooks file is often the best option when your existing file is corrupted and causing issues like payroll problems and direct deposit failures. Having two separate QuickBooks files under the same EIN can be a viable solution, allowing you to manage current payroll in a new file while maintaining historical data in the old one.

If you’re still struggling with these issues and need assistance, contact QuickBooks support at 844-753-8012 for help with setting up your new file and resolving any payroll issues.

If your existing QuickBooks Enterprise Desktop file becomes corrupted, particularly with employee data or payroll issues like Direct Deposit, creating a fresh file for the new year helps resolve ongoing problems and streamline operations.

Yes, you can create two separate QuickBooks files under the same EIN. One file can manage historical data, while the new file can be used for current payroll and operations.

To set up Direct Deposit in a new file, go to Employee Center, choose the employee, and set up payroll preferences. Make sure all bank account and payroll settings are updated and configured correctly.

Yes, you can use both files: the old file for historical data and reporting, and the new file for current payroll and transactions. Be sure to manage them separately to avoid confusion.

If you continue to experience issues with Direct Deposit in the new file, it may be a setup issue or a software bug. Contact QuickBooks Support at 844-753-8012 for assistance.