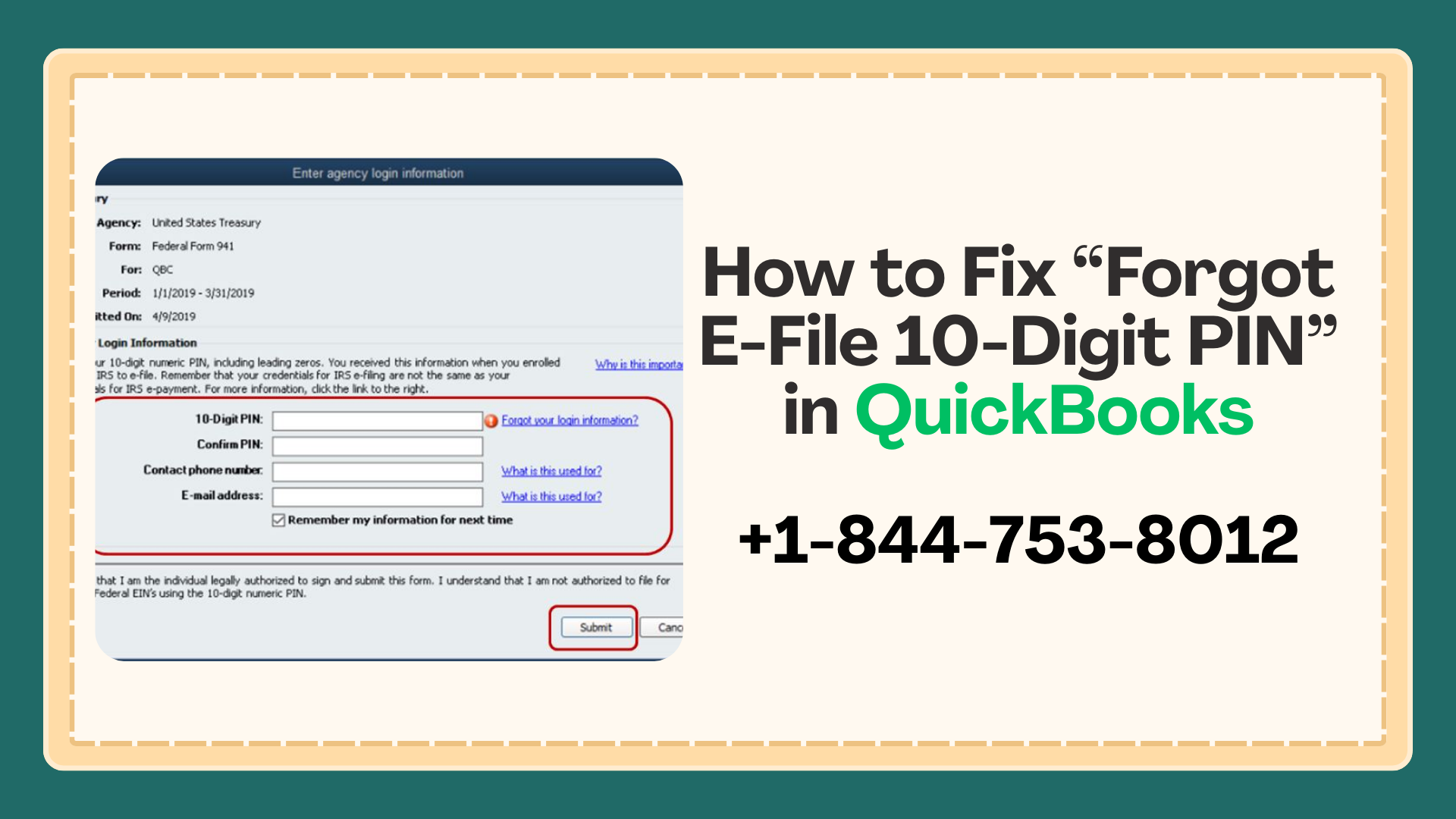

If you’re filing your quarterly Form 941 in QuickBooks and suddenly see that your e-file 10-digit PIN is no longer populated, it can stop the filing process immediately. Many users report that the PIN usually fills in automatically, but this time it’s missing—and they don’t remember what the PIN is.

This is a common QuickBooks payroll issue, and understanding why it happens will help you resolve it faster.

What Is the E-File 10-Digit PIN in QuickBooks?

The IRS e-file 10-digit PIN is used to electronically sign and submit federal payroll tax forms, including Form 941. When payroll is set up correctly, QuickBooks saves this PIN and automatically populates it during filing.

If the PIN field is blank, QuickBooks cannot complete the e-file process.

Also Read: Creating a New QuickBooks File After Corruption Issues: What You Need to Know

Why Is My E-File 10-Digit PIN Not Populated in QuickBooks?

There are several reasons this issue can occur, even if everything worked fine before:

- A QuickBooks update removed saved e-file credentials

- Changes to your payroll subscription or company file

- Filing under a different EIN or user login

- The PIN was never permanently saved during initial setup

- IRS security requirements triggered re-authorization

Even small system or account changes can cause the e-file PIN to disappear.

How Can I Find or Recover My E-File 10-Digit PIN?

For security reasons, the IRS does not allow users to view or retrieve an existing e-file PIN. However, you still have solutions:

Re-Authorize E-File in QuickBooks

QuickBooks allows you to re-complete the e-file authorization process, which generates a new 10-digit PIN and restores filing access.

Check Previous Filing Records

Some users may have saved the PIN in prior 941 filing confirmations or payroll setup documents.

Contact Professional Support

If you’re unsure how to reset the PIN or are facing filing deadlines, expert help can ensure everything is completed correctly.

📞 Call 844-753-8012 for assistance with resetting your QuickBooks e-file 10-digit PIN and successfully filing Form 941.

Related Keywords

- forgot e-file 10-digit PIN QuickBooks

- QuickBooks e-file PIN not populated

- Form 941 e-file PIN missing

- recover e-file PIN QuickBooks

- QuickBooks payroll e-file issue

Also Read: How to Restore a Deleted Department in QuickBooks When Posting a Deposit

Final Thoughts

Forgetting your e-file 10-digit PIN in QuickBooks can be stressful, especially when filing quarterly payroll forms like Form 941. While the PIN itself cannot be retrieved, re-authorizing your e-file setup is usually the fastest and most effective solution.

If the issue persists or you’re short on time, getting professional help can prevent delays and potential IRS penalties.

This usually happens due to QuickBooks updates, payroll subscription changes, company file modifications, or IRS security requirements. Any of these can remove saved e-file credentials.

No. For security reasons, the IRS does not allow users to view or retrieve an existing e-file PIN. You must re-authorize e-file to generate a new PIN.

You can reset the PIN by completing the e-file re-authorization process within QuickBooks Payroll. This creates a new 10-digit PIN and restores your filing ability.

No. Resetting or re-authorizing your e-file PIN does not change or impact previously filed payroll tax forms or IRS records.

If you’re on a deadline and the missing PIN is blocking your filing, contacting QuickBooks payroll support can help you re-authorize quickly and avoid penalties.

You can contact payroll experts for help with missing or forgotten e-file PINs by calling 844-753-8012 for fast assistance.