Filing 1099s correctly is critical for business owners, bookkeepers, and accountants using QuickBooks Online. One of the most confusing areas is how to report a sole proprietor’s business name on a 1099 in QuickBooks Online. Many users struggle with questions like where to put the business name on 1099 QuickBooks Online, why QuickBooks auto-fills certain fields, or how to ensure IRS compliance when paying subcontractors.

If you’re dealing with QuickBooks Online 1099 sole proprietor reporting, this guide will walk you through everything step by step—clearly, accurately, and in compliance with IRS rules.

📞 Need help setting up or fixing 1099s in QuickBooks Online? Call 844-753-8012 for expert assistance.

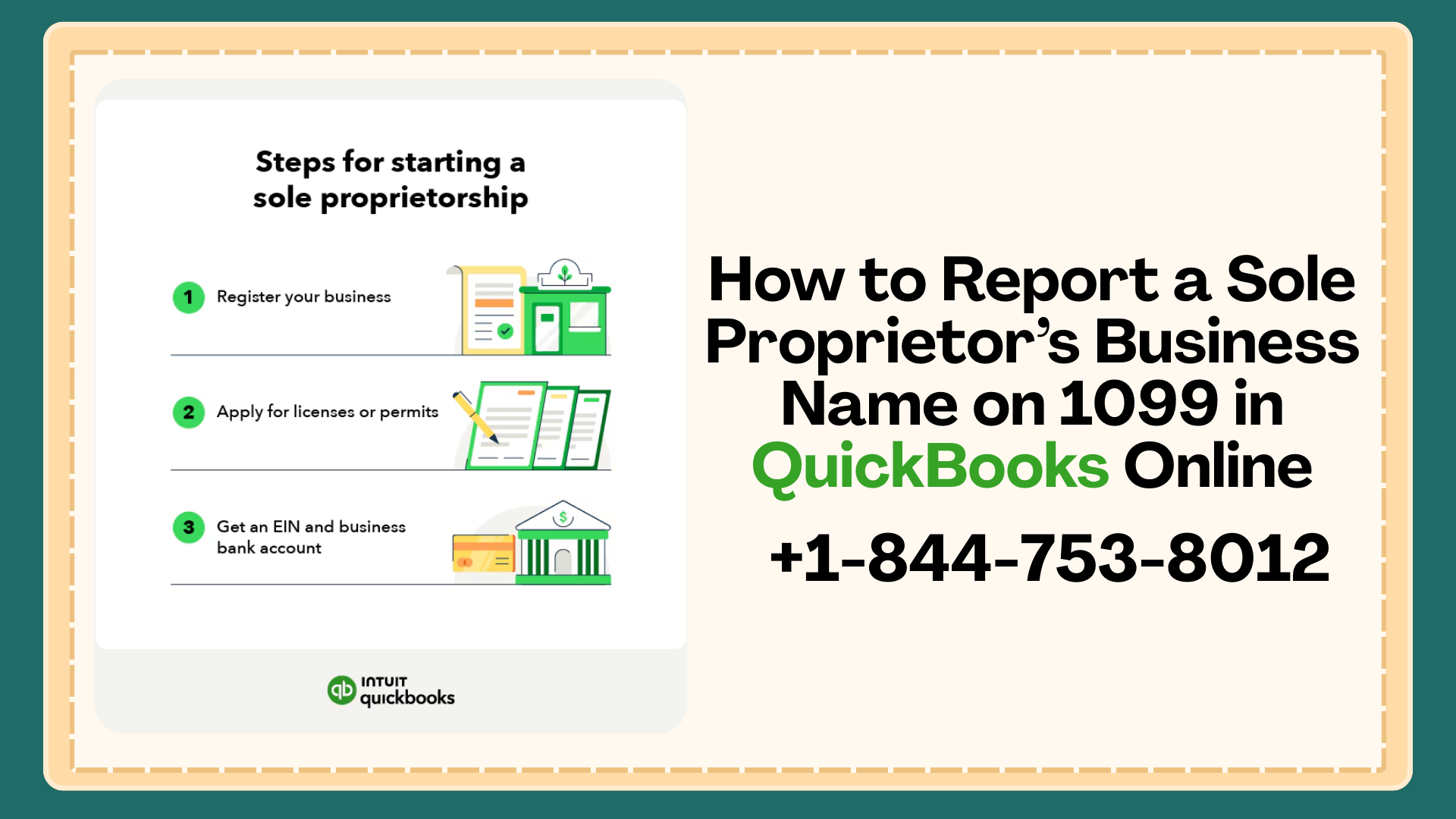

Understanding 1099 Reporting for Sole Proprietors

Before diving into QuickBooks Online, it’s important to understand how the IRS views sole proprietors.

A sole proprietor:

-

Operates under their own name or a business name (DBA)

-

Reports income using their Social Security Number (SSN) or Employer Identification Number (EIN)

-

Receives Form 1099-NEC for nonemployee compensation

When handling sole proprietor 1099 reporting in QBO, the key detail is this:

The IRS matches the 1099 name to the taxpayer ID (SSN or EIN), not just the business name.

This rule directly affects how QuickBooks Online 1099 auto-fill works.

Common Confusion: Business Name vs. Legal Name on 1099

One of the most frequent questions is:

“Where do I put the business name on 1099 QuickBooks Online?”

Here’s the IRS-compliant answer:

-

Legal Name → Must match the name associated with the SSN or EIN

-

Business Name (DBA) → Goes in the “Business Name” field (optional, secondary)

If this is entered incorrectly, QuickBooks may still file the form—but the IRS could reject it.

How QuickBooks Online Handles 1099 Auto-Fill

QuickBooks Online pulls 1099 information from:

-

Contractor profile details

-

Payment transactions

-

Account mapping

-

Tax settings

This is why users often search for a QBO 1099 auto-fill guide—the process feels automatic, but setup accuracy matters.

If your contractor profile is incorrect, QuickBooks Online 1099 auto-fill will populate the wrong name or leave the business name off entirely.

Step-by-Step: How to Show Business Name on 1099 in QBO

Follow these steps to properly report a sole proprietor’s business name on a 1099 in QuickBooks Online.

Step 1: Set Up the Contractor Correctly

-

Go to Expenses > Contractors

-

Select the contractor or click Add contractor

-

Choose Independent contractor

This ensures the contractor is eligible for QuickBooks Online 1099 for contractors reporting.

Step 2: Enter Tax Information Carefully

Inside the contractor profile:

-

Legal Name

-

Enter the individual’s name if SSN is used

-

Enter the business name only if the EIN is registered to the business

-

-

Business Name

-

Enter the DBA or company name (if applicable)

-

This step directly impacts reporting sole proprietor on 1099 QuickBooks.

Step 3: Enter Tax ID Correctly

-

Use SSN if the sole proprietor reports under their personal tax ID

-

Use EIN if they’ve registered one

⚠️ The IRS matches the first name line to the tax ID—this is why accuracy is critical.

How QuickBooks Online Determines What Appears on the 1099

When generating 1099s, QuickBooks uses this logic:

-

Legal name tied to SSN/EIN appears on Recipient Name

-

Business name appears on Business Name line

-

Payments are totaled from mapped expense accounts

If the name doesn’t match IRS records, you may receive filing errors or IRS notices.

QuickBooks Online 1099 Setup: What You Must Check

To avoid problems, confirm these settings before filing:

✔ 1099 Settings

-

Go to Taxes > 1099 filings

-

Ensure 1099 tracking is ON

✔ Account Mapping

-

Map expense accounts used for contractor payments

-

Unmapped accounts won’t appear on 1099s

✔ Payment Methods

-

Credit card and PayPal payments are excluded

-

Only cash, check, ACH, and direct deposit count

These steps are essential for accurate QuickBooks Online contractor payments reporting.

Also Read:

1099 Subcontractor Sole Proprietor: Common Mistakes to Avoid

Many errors occur due to simple setup issues:

❌ Entering business name as legal name when SSN is used

❌ Leaving tax ID field blank

❌ Paying contractors through excluded payment methods

❌ Not reviewing 1099 preview before filing

Avoiding these mistakes ensures smooth 1099 subcontractor sole proprietor QuickBooks processing.

Reviewing 1099s Before Filing in QuickBooks Online

Always review your forms before submission:

-

Go to Taxes > 1099 filings

-

Select Review

-

Check:

-

Legal name

-

Business name

-

Tax ID

-

Payment totals

-

This review step is a must-follow best practice for QuickBooks Online 1099 filing tips for sole proprietors.

How to Edit a Sole Proprietor’s Name on a 1099 in QBO

If you notice an error:

-

Go to Expenses > Contractors

-

Open the contractor profile

-

Edit legal name or business name

-

Save changes

-

Re-run the 1099 review

QuickBooks updates the form automatically once corrected.

What If You Already Filed the 1099?

If the form has already been submitted with incorrect information:

-

You may need to file a corrected 1099-NEC

-

QuickBooks Online allows corrected filings directly

📞 For help with corrected 1099s, call 844-753-8012 to speak with a QuickBooks expert.

Why Proper 1099 Reporting Matters

Incorrect 1099s can lead to:

-

IRS penalties

-

Contractor disputes

-

Delayed tax filings

-

Compliance audits

That’s why accurate QuickBooks Online 1099 sole proprietor setup is more than just data entry—it’s risk management.

When to Get Professional Help

You should seek expert help if:

-

You manage multiple subcontractors

-

Contractors use mixed SSN/EIN structures

-

1099s aren’t auto-filling correctly

-

You received IRS notices

Call 844-753-8012 for professional QuickBooks Online 1099 support.

Final Thoughts

Understanding how to report a sole proprietor’s business name on 1099 in QuickBooks Online doesn’t have to be confusing. By entering the legal name correctly, using the right tax ID, and reviewing your forms before filing, you can ensure full IRS compliance.

Whether you’re dealing with QuickBooks Online 1099 setup, contractor payments, or auto-fill issues, getting it right the first time saves time, money, and stress.

Need expert help now? Call 844-753-8012 and get your QuickBooks Online 1099s handled correctly and confidently.

Frequently Asked Questions (FAQs)

To report a sole proprietor in QuickBooks Online 1099, set them up as an independent contractor, enter their legal name exactly as it appears with their SSN or EIN, and complete the 1099 setup under Taxes.

In QuickBooks Online, enter the individual’s name in the Legal Name field and the DBA or company name in the Business Name field. This ensures correct sole proprietor 1099 reporting in QBO.

QuickBooks Online 1099 auto-fill pulls data from the contractor profile. If the legal name or tax ID is entered incorrectly, the wrong name may appear on the 1099 form.

Yes. How to show business name on 1099 in QBO depends on proper setup. The legal name appears on the primary recipient line, and the business name appears as a secondary line when entered correctly.

Yes. Sole proprietors who receive $600 or more for services must be issued a 1099-NEC using QuickBooks Online 1099 for contractors.

This usually happens when the contractor is not marked as eligible for 1099, the expense account is not mapped, or payments were made via credit card or PayPal. This affects subcontractor 1099 QuickBooks Online reporting.

Edit the contractor profile, update the legal name or business name, save the changes, and review the 1099 again. QuickBooks will refresh the form automatically.

Yes. QuickBooks Online contractor payments are tracked automatically as long as payment methods and expense accounts are set up correctly during QuickBooks Online 1099 setup.

If filed incorrectly, you may need to submit a corrected 1099-NEC. QuickBooks Online allows corrections, but it’s best to fix issues before filing. Call 844-753-8012 for help with corrected or rejected 1099s.

You should seek help if:

1099s are not auto-filling

You manage multiple sole proprietors

The IRS rejects your filing

📞 Call 844-753-8012 for expert QuickBooks Online 1099 support.