Filing Form 1099-NEC can be confusing—especially when a contractor changes states during the year. One of the most common questions business owners and accountants ask is:

What goes in Box 6 of Form 1099-NEC if the contractor moved out of state?

Should you enter the new state? The old state? Both? Or do you leave it blank?

In this guide, we’ll break down everything you need to know about Form 1099-NEC Box 6, how state tax withholding works, what to do when contractors move, and how to stay compliant with IRS and state reporting rules.

📞 Need help with 1099 filing or corrections? Call 844-753-8012 to speak with a tax reporting expert.

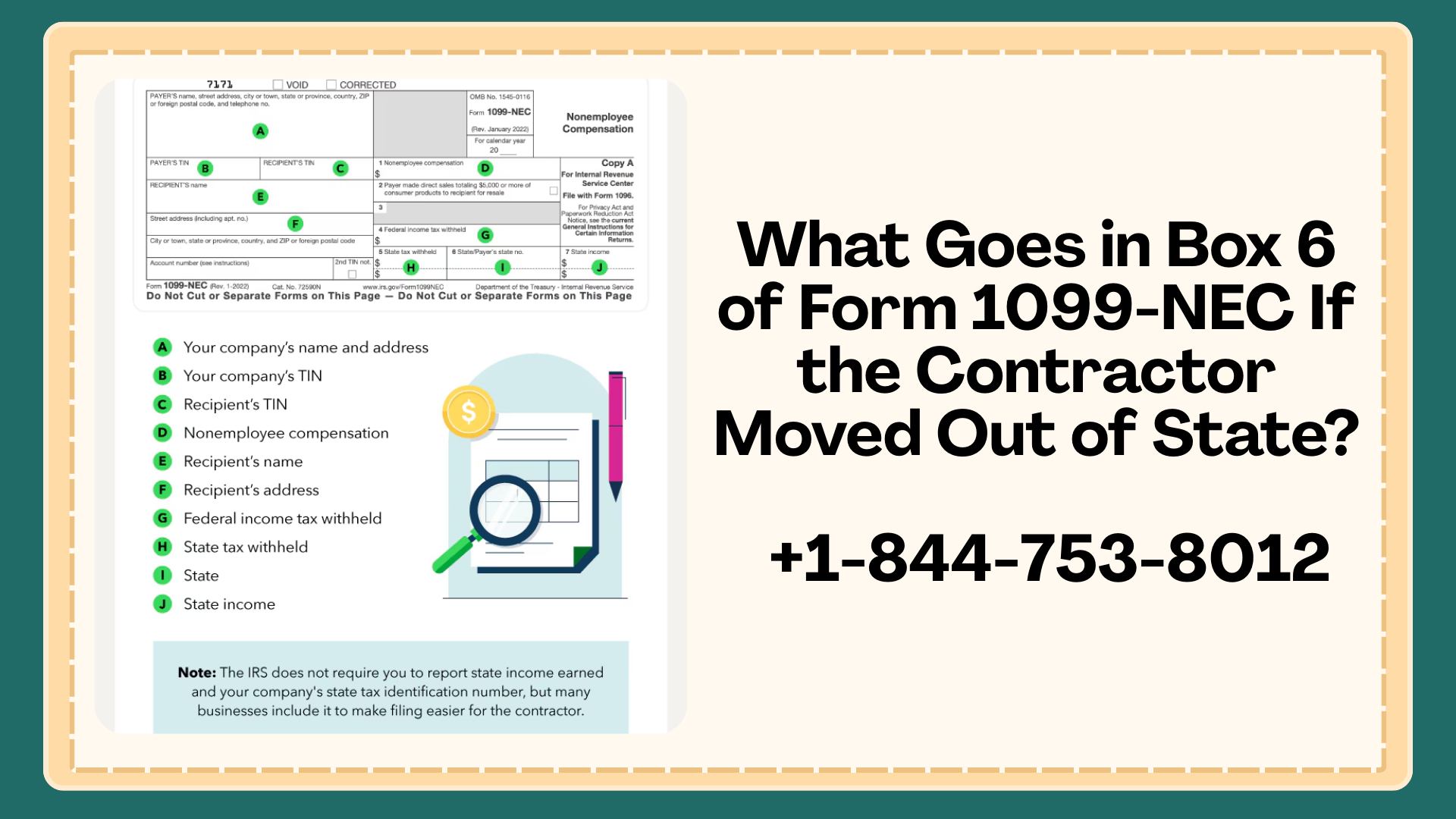

Understanding Form 1099-NEC and Box 6

Form 1099-NEC (Nonemployee Compensation) is used to report payments of $600 or more made to independent contractors.

Key boxes on Form 1099-NEC:

- Box 1 – Nonemployee compensation

- Box 4 – Federal income tax withheld (backup withholding)

- Box 5 – State tax withheld

- Box 6 – State

- Box 7 – State income

This article focuses specifically on Form 1099-NEC Box 6, also known as the state tax box on 1099-NEC.

Also Read: How to Fix Missing Credit Card Transactions After Web Connect Import in QuickBooks Desktop

What Is Box 6 on Form 1099-NEC?

Box 6 on 1099-NEC is used to report the state associated with any state tax withholding reported in Box 5.

👉 Important rule:

If no state tax was withheld, Box 6 is usually left blank.

This is where confusion begins—especially with out-of-state contractors.

1099-NEC No State Withholding: The General Rule

For most independent contractors:

- States do not require mandatory withholding

- Contractors pay their own state taxes

- Businesses do not withhold state income tax

That means in many cases:

- Box 5 = blank

- Box 6 = blank

- Box 7 = blank

This applies even if the contractor:

- Moved to another state

- Worked remotely

- Changed residency mid-year

So yes—you often leave Box 6 blank on 1099-NEC.

What to Put in Box 6 on 1099-NEC (Plain Answer)

✅ Put a state in Box 6 only if:

- You withheld state income tax

- The state required reporting

- Box 5 has a dollar amount

❌ Leave Box 6 blank if:

- No state tax was withheld

- Contractor paid their own state taxes

- Payments were reported only to the IRS

This rule holds true even for a 1099-NEC contractor who moved out of state.

1099-NEC Box 6: Contractor Moved Out of State

Let’s address the core question directly.

Scenario:

Your contractor lived in State A at the beginning of the year, moved to State B mid-year, and you paid them throughout the year.

What goes in Box 6?

👉 Nothing—unless state tax was withheld.

The contractor’s change of address does not automatically affect Box 6.

Why Contractor Residency Usually Doesn’t Matter for Box 6

Unlike W-2 employees, independent contractors are responsible for their own taxes.

That means:

- You report what you paid, not where they lived

- You report withholding, not residency

- The IRS and states rely on the contractor’s own tax return

This is why 1099-NEC state income tax withheld is the determining factor—not the contractor’s address.

When Box 6 MUST Be Filled In

There are specific situations where Box 6 on Form 1099-NEC must be completed.

1. State Requires Withholding on Contractors

Some states require or allow withholding, such as:

- California (backup withholding)

- Maine

- Vermont (limited cases)

If you withheld state tax:

- Enter the state abbreviation in Box 6

- Enter the withheld amount in Box 5

2. Backup Withholding at the State Level

If the contractor:

- Failed to provide a correct TIN

- Was subject to backup withholding

- And your state requires reporting

Then Box 6 is used for 1099-NEC state tax withheld.

3. Multi-State 1099-NEC Reporting

In rare cases:

- You withheld tax for more than one state

- The contractor worked in multiple states

- State filing is required

You may need to:

- Issue multiple 1099-NEC forms

- Or attach additional state copies

📞 Multi-state reporting can get complex—call 844-753-8012 for professional help.

What If the Contractor Moved Mid-Year?

This is a common concern in independent contractor moved states tax reporting.

Example:

- Contractor lived in Texas (no state income tax)

- Moved to California mid-year

- No state tax was withheld

Result:

- Box 6 remains blank

- No state is listed

- Contractor reports income on their CA return

The move itself does not trigger Box 6 reporting.

1099-NEC State Reporting Requirements: What Businesses Get Wrong

Here are common mistakes businesses make:

❌ Putting the contractor’s new state in Box 6

❌ Entering the business’s state instead of the withholding state

❌ Filling Box 6 when Box 5 is blank

❌ Issuing corrected forms unnecessarily

Remember:

Box 6 is about withholding—not location.

IRS 1099-NEC Instructions (Simplified)

According to IRS 1099-NEC instructions:

- Boxes 5–7 are used only when state information is required

- States use these boxes to match withholding

- If there’s no withholding, these boxes may be left blank

This guidance supports 1099-NEC no state withholding situations.

Also Read: How to Fix Missing Payment Method Options in QuickBooks Self-Employed

Do You Ever Need to Update a 1099 Because a Contractor Moved?

Usually, no.

You only need to issue a corrected 1099-NEC if:

- The dollar amount was wrong

- The tax ID was incorrect

- Withholding was reported incorrectly

A change of address alone does not require correction.

Best Practices for Out-of-State Contractor 1099 Filing

To stay compliant:

✔ Collect a completed W-9

✔ Do not assume state withholding is required

✔ Follow your state’s rules—not the contractor’s

✔ Leave Box 6 blank if no state tax was withheld

✔ Review forms before filing

When Should You Get Professional Help?

You should seek expert help if:

- You withheld state taxes

- Contractors moved between multiple states

- You’re unsure about state filing rules

- You received a state tax notice

- You need to file corrected 1099-NEC forms

📞 Call 844-753-8012 to get accurate 1099-NEC guidance and avoid penalties.

Also Read: How to Report a Sole Proprietor’s Business Name on 1099 in QuickBooks Online

Final Thoughts

So, what goes in Box 6 of Form 1099-NEC if the contractor moved out of state?

👉 In most cases: nothing at all.

Unless you withheld state income tax, Box 6 should be left blank, regardless of where the contractor lived or moved during the year.

Understanding how 1099-NEC Box 6, state tax withholding for contractors, and multi-state 1099-NEC reporting work can save you from filing errors, corrections, and penalties.

📞 Need help with 1099-NEC filing or corrections? Call 844-753-8012 and speak with a reporting expert today.