QuickBooks users often rely on the “Prep My Own” 1099 option to manually prepare and review forms before filing. However, a common problem many encounter is missing vendors in QuickBooks 1099. You may notice that QuickBooks 1099 only shows one vendor, or some contractors aren’t listed at all.

If you’re struggling with a QuickBooks 1099 Prep My Own issue, this guide will help you troubleshoot, identify causes, and fix the QuickBooks 1099 vendor display issue so all your vendors are correctly listed.

Need immediate help? Call 844-753-8012 for expert QuickBooks 1099 support.

Understanding QuickBooks 1099 Filing Options

QuickBooks offers two main options for preparing 1099 forms:

- Autofilled 1099 forms – QuickBooks automatically pulls eligible vendors and payments into 1099 forms. This method ensures all vendors with qualifying payments appear correctly.

- “Prep My Own” 1099 forms – Users manually select which vendors to include and review the form before filing. While it gives flexibility, it also increases the chances of missing vendors.

Many businesses choose Prep My Own to verify totals, make adjustments, or review multi-state 1099s. However, the risk is that QuickBooks may not list all vendors, creating a QuickBooks 1099 filing problem.

Also Read: How to Fix Missing Credit Card Transactions After Web Connect Import in QuickBooks Desktop

Common Reasons for Missing Vendors in QuickBooks 1099

Understanding why vendors disappear is the first step in fixing the issue. Common reasons include:

1. Vendor Not Marked as 1099 Eligible

Each vendor must be flagged for 1099 reporting:

- Go to Vendors > Vendor Center

- Select the vendor and click Edit Vendor

- Check Track payments for 1099

If this box is unchecked, the vendor will not appear in Prep My Own 1099 forms.

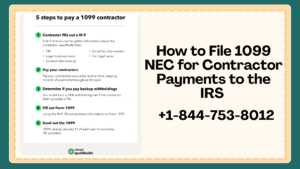

2. Payments Do Not Meet Threshold

The IRS requires reporting for payments totaling $600 or more per year (for most services). Vendors paid less than the threshold may not appear automatically.

3. Payment Categorization Issues

QuickBooks tracks payments based on expense accounts:

- Only payments to accounts mapped to 1099 boxes are included

- If payments are recorded in non-eligible accounts, vendors may be missing

Check QuickBooks 1099 filing tips for proper account mapping.

Also Read: How to Fix Missing Payment Method Options in QuickBooks Self-Employed

4. Vendor Mismatch or Duplicate Records

Some vendors may have multiple entries:

- Different spellings

- Variations in company name

- Multiple vendor IDs

QuickBooks may list one vendor and exclude others, causing a QuickBooks 1099 vendor mismatch issue.

5. Using “Prep My Own” vs Autofilled Forms

Autofilled forms automatically include all qualifying vendors. In contrast, Prep My Own requires manual selection, increasing the chance of QuickBooks 1099 vendor not appearing.

Step-by-Step Guide to Fix Missing Vendors in QuickBooks 1099 “Prep My Own”

Follow these steps carefully to troubleshoot QuickBooks 1099 vendor display issues.

Step 1: Verify 1099 Vendor Setup

- Open Vendor Center

- Select the missing vendor

- Click Edit Vendor

- Ensure Track payments for 1099 is checked

This is the most common fix for QuickBooks Desktop 1099 vendor problem.

Step 2: Check Payment Thresholds

- Go to Reports > Vendor Reports

- Select Vendor Balance Detail

- Verify the total payments meet the IRS 1099 reporting threshold ($600+)

Vendors below the threshold will not appear even if Track payments for 1099 is checked.

Also Read: How to Report a Sole Proprietor’s Business Name on 1099 in QuickBooks Online

Step 3: Review Payment Accounts

QuickBooks maps vendor payments to 1099 boxes using specific accounts:

- Go to Edit > Preferences > Tax: 1099

- Click Company Preferences

- Verify expense accounts are mapped to correct 1099 boxes

If your vendor payments were posted to unmapped accounts, they won’t appear in Prep My Own 1099.

Step 4: Resolve Vendor Mismatch

If a vendor exists in multiple records:

- Merge duplicates:

- Vendor Center > Edit Vendor > Merge

- Ensure all payments are associated with the correct vendor record

This fixes QuickBooks 1099 vendor mismatch issues.

Step 5: Compare “Prep My Own” vs Autofilled Forms

Sometimes vendors appear in autofilled 1099 forms showing all vendors QuickBooks but not in Prep My Own.

- Review Autofilled Form as a reference

- Cross-check missing vendors

- Add manually in Prep My Own if necessary

This ensures no contractor is left out.

Step 6: Refresh or Rebuild QuickBooks Data

Corrupt company files can cause QuickBooks 1099 vendor display issues.

- Go to File > Utilities > Verify Data

- Then File > Utilities > Rebuild Data

After rebuilding, check the Prep My Own vendor list again.

Step 7: Update QuickBooks

Many vendor list bugs are resolved in updates:

- Go to Help > Update QuickBooks

- Install all available updates

- Restart QuickBooks and recheck Prep My Own 1099 forms

Step 8: Consider QuickBooks Online or Third-Party Options

If you use QuickBooks Online:

- Check QuickBooks Online 1099 prep options

- Verify vendor 1099 eligibility in QBO

- Cross-check autofilled 1099 forms against Prep My Own

Third-party 1099 apps can also ensure all vendors are included.

Also Read: What Goes in Box 6 of Form 1099-NEC If the Contractor Moved Out of State?

📞 Call 844-753-8012 for expert guidance on QuickBooks 1099 Prep My Own issues.

Tips to Avoid Missing Vendors in Future 1099 Filings

- Flag all vendors for 1099 reporting early in the year

- Ensure payments are posted to 1099-eligible accounts

- Merge duplicate vendor records before year-end

- Compare Prep My Own with autofilled forms

- Update QuickBooks regularly

- Use reports to verify vendor totals before filing

When to Seek Professional Help

Contact an expert if:

- Missing vendors still don’t appear after verifying eligibility

- You encounter QuickBooks 1099 only shows one vendor

- You are unsure about account mapping or state reporting

- You need to file corrected 1099 forms

📞 Call 844-753-8012 for professional QuickBooks 1099 filing support.

Final Thoughts

Missing vendors in QuickBooks 1099 “Prep My Own” forms are usually caused by:

- Vendors not marked 1099-eligible

- Payments below IRS thresholds

- Payments posted to non-mapped accounts

- Duplicate or mismatched vendor records

By following the steps in this guide, you can fix QuickBooks 1099 vendor display issues and ensure all contractors are properly reported.

Using autofilled 1099 forms as a reference or working with a QuickBooks expert can help avoid filing mistakes and IRS penalties.

📞 Need help today? Call 844-753-8012 to troubleshoot missing vendors in QuickBooks 1099 Prep My Own forms.