For small business owners, freelancers, and accountants, filing Form 1099-NEC is an essential part of reporting contractor payments to the IRS. Whether you’re paying independent contractors, freelancers, or other nonemployees, understanding how to file 1099-NEC, meeting IRS 1099-NEC instructions, and avoiding penalties is crucial.

In this guide, we’ll cover everything from eligibility, deadlines, and reporting rules to QuickBooks 1099-NEC filing and step-by-step e-filing instructions.

Need help filing 1099-NEC? Call 844-753-8012 to speak with a tax filing expert.

What Is Form 1099-NEC?

Form 1099-NEC (Nonemployee Compensation) is used to report payments of $600 or more made to contractors and freelancers. This form replaced Box 7 of Form 1099-MISC for nonemployee compensation starting in tax year 2020.

Who needs 1099-NEC?

- Independent contractors

- Freelancers

- Vendors or service providers who are not employees

If you made a 1099-NEC contractor payment during the tax year, the IRS expects a report to ensure income is properly taxed.

Also Read: What Goes in Box 6 of Form 1099-NEC If the Contractor Moved Out of State?

Why Filing 1099-NEC Matters

Failing to file 1099-NEC correctly can lead to:

- IRS penalties for late or missing forms

- Additional interest on underreported contractor income

- Compliance issues for state reporting

Following the IRS 1099-NEC instructions ensures accurate reporting and keeps your business in good standing.

1099-NEC Filing Rules and Requirements

Here’s a summary of the key 1099-NEC reporting rules:

- Threshold: Payments of $600 or more per contractor per year

- Eligible payees: Individuals, partnerships, and LLCs treated as partnerships or sole proprietors

- Ineligible payees: Corporations, except attorneys in certain cases

- Payment types: Cash, checks, bank transfers, and other property payments

- Due dates: Forms must be sent to contractors by January 31 and to the IRS by January 31 (for paper or electronic filing)

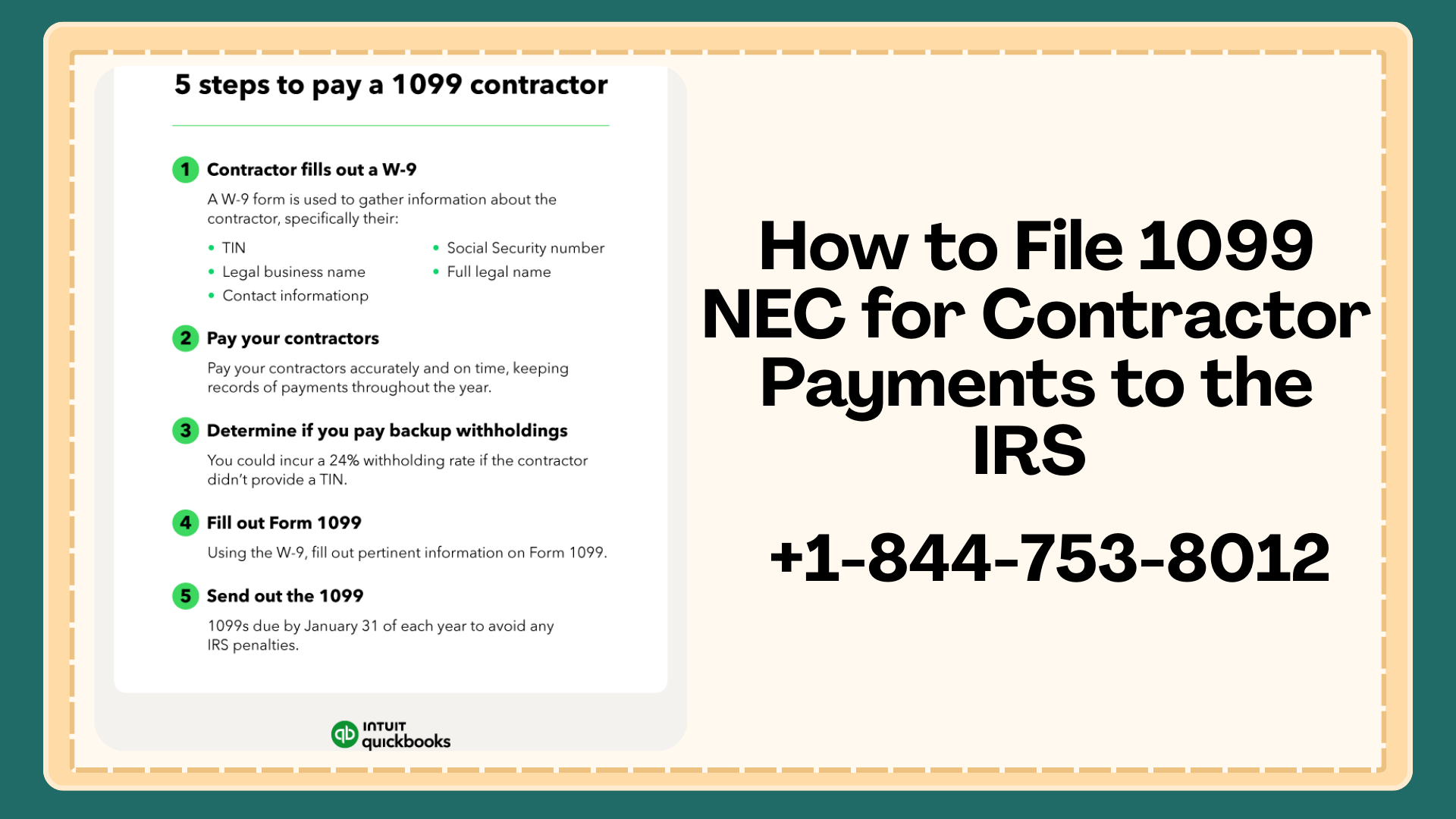

Step 1: Collect Contractor Information

Before filing, ensure you have the following for each contractor:

- Legal name

- Business name (if applicable)

- Address

- Taxpayer Identification Number (TIN)

- Total payment amounts

Use Form W-9 to collect this information. Without a W-9, you may be required to withhold backup withholding at 24%.

Step 2: Determine Payments Subject to Reporting

Not all payments are reported on 1099-NEC. Common 1099-NEC contractor payments include:

- Fees for services

- Commissions

- Professional fees (attorneys, accountants, consultants)

- Bonuses

Do not include employee wages, business-to-business payments to corporations, or reimbursements for expenses unless specifically required.

Also Read: How to Report a Sole Proprietor’s Business Name on 1099 in QuickBooks Online

Step 3: Choose Filing Method

You have two options to file 1099-NEC with IRS:

Paper Filing

- Order official 1099-NEC forms (cannot print from PDF)

- Fill out each form for each contractor

- Mail copies to contractors and IRS

E-Filing (Recommended)

- E-file 1099-NEC with IRS using approved software

- Faster, more accurate, and secure

- Supports bulk submissions for multiple contractors

Call 844-753-8012 if you need assistance e-filing 1099-NEC forms.

Step 4: Filing 1099-NEC Online

To e-file 1099-NEC with IRS:

- Choose IRS-approved e-filing software or QuickBooks for 1099-NEC filing

- Enter contractor information from W-9 forms

- Enter total payments for the tax year

- Confirm the IRS filing format and transmit

- Provide contractors with copies (can be mailed or digital)

Step 5: QuickBooks 1099-NEC Filing

QuickBooks (Desktop and Online) simplifies filing:

- Mark vendors as 1099-eligible in QuickBooks

- Assign payments to correct expense accounts

- Go to Vendors > Prepare 1099s

- Review autofilled 1099 forms or choose Prep My Own

- E-file directly through QuickBooks or export to IRS-approved e-file software

Tip: Always compare QuickBooks 1099-NEC filing with contractor records to avoid missing payments.

Step 6: Filing Deadlines

Important 1099-NEC due dates:

- Send forms to contractors: January 31

- File forms with IRS (paper or electronic): January 31

Late filings may incur penalties depending on the delay:

- Within 30 days: $50 per form

- 31–60 days late: $110 per form

- After August 1: $290 per form

Step 7: Correcting Mistakes

If you discover errors after filing:

- Prepare a corrected 1099-NEC

- Follow IRS instructions to indicate corrected forms

- Submit corrected forms to IRS and provide updated copies to contractors

Also Read: How to Fix Missing Payment Method Options in QuickBooks Self-Employed

1099-NEC Step by Step Checklist

- Collect W-9s from all contractors

- Verify total payments reach $600 threshold

- Mark vendors as 1099-eligible in QuickBooks or your accounting software

- Map payments to proper accounts

- Decide on Prep My Own or autofill options

- E-file or mail forms to IRS

- Provide copies to contractors

- Correct any mistakes promptly

Special Cases: Freelancers and Multi-State Reporting

- 1099-NEC for freelancers: Treat like any contractor, ensure proper tracking of payments and state reporting if applicable

- Multi-state reporting: Some states require separate 1099 filing even if federal filing is complete. Check state-specific 1099 instructions.

Tips for Smooth 1099-NEC Filing

- File early to avoid errors or late penalties

- Maintain accurate records of all contractor payments

- Use accounting software like QuickBooks to simplify calculations

- Double-check TINs and vendor names

- Retain copies of 1099 forms for at least 4 years

When to Call an Expert

You should contact a professional if:

- You have multiple contractors or large numbers of 1099 forms

- You need help with QuickBooks 1099-NEC filing

- You’re unsure about e-filing procedures

- You need guidance for multi-state contractor payments

Call 844-753-8012 for expert help filing 1099-NEC forms with the IRS.

Final Thoughts

Filing 1099-NEC correctly is essential for staying compliant with IRS rules and avoiding penalties. By following this step-by-step 1099-NEC filing guide, you can:

- Report contractor payments accurately

- Meet deadlines for both contractors and IRS

- Correct mistakes efficiently

- Use QuickBooks or e-file software to simplify the process

Remember, collecting accurate information and following IRS 1099-NEC instructions is key to smooth filing.

Need immediate help with filing 1099-NEC or e-filing with the IRS? Call 844-753-8012 today.