Filing payroll tax forms accurately is critical—but mistakes can happen, especially during busy year-end payroll processing. One of the most common and confusing issues employers face is a duplicate W-3 filed electronically in QuickBooks Desktop. If you’re searching for answers because you filed W-3 twice by mistake, saw a message saying SSA received duplicate W-3, or noticed QuickBooks W-2/W-3 status not updating, this guide is for you.

In this article, we’ll explain what happens if you file W-3 twice by mistake, how to correct duplicate W-3 with the SSA, how it impacts W-2s and employees, and the exact steps to fix the issue correctly—without creating bigger payroll or compliance problems.

If you need immediate help, you can call 844-753-8012 for expert QuickBooks payroll support.

What Is a Duplicate W-3 Filed Electronically?

A duplicate W-3 filed electronically occurs when the same W-3 transmittal is submitted more than once to the Social Security Administration (SSA). Since the W-3 summarizes all employee W-2 wage and tax data, filing it twice can cause:

- Duplicate wage totals at the SSA

- Overreported earnings

- Mismatches between W-2 and W-3 records

- Payroll tax filing errors

- Potential notices from the SSA

This issue is most commonly seen in QuickBooks Desktop, especially when users are unsure whether the first electronic submission was successful.

Also Read: How to Fix Duplicate W-2 Forms Filed Electronically in QuickBooks Desktop

What Happens If I File W-3 Twice by Mistake?

This is one of the most frequently asked questions—and understandably so.

If you file W-3 twice by mistake, the SSA may:

- Record duplicate wage totals

- Flag your EIN for discrepancies

- Show W-3 submitted twice electronically

- Trigger mismatches between W-2 and W-3 data

- Delay processing of employee wage records

The good news is that filing a duplicate W-3 does not automatically mean penalties, as long as the issue is identified and corrected properly.

Common Reasons Duplicate W-3 Filing Happens in QuickBooks Desktop

1. QuickBooks W-2/W-3 Status Not Updating

Many users encounter this scenario:

- SSA says W-3 received but QuickBooks says submitted

This leads users to refile, causing a duplicate W-3 filed electronically.

2. Software Freeze or Timeout

If QuickBooks Desktop freezes or closes during submission, users may resend the W-3 without realizing the SSA already received it.

3. Multiple Payroll Admins

When more than one admin has payroll access, it’s easy for the same W-3 to be submitted twice.

4. Corrections Made After Filing

Making payroll changes and attempting to “resend” forms instead of using corrections can result in duplicate W-3 submission.

SSA Says W-3 Received but QuickBooks Says Submitted—Which One Is Right?

This causes a lot of confusion.

Important rule:

👉 SSA confirmation always overrides QuickBooks status

QuickBooks Desktop does not always update filing status in real time. Before re-filing, always check:

- SSA Business Services Online (BSO)

- Submission confirmation numbers

- Filing timestamps

Refiling without checking is one of the top causes of W-3 submitted twice electronically.

Also Read: Can’t Find Profit and Loss Report in QuickBooks? Here’s the Fix

SSA Received Duplicate W-3: What Should You Do First?

Before taking action:

Step 1: Verify in SSA BSO

Log in and confirm whether:

- One or multiple W-3s were received

- Wage totals are duplicated

Step 2: Check Employee W-2 Records

If the W-3 duplication impacts W-2 totals, you may also need to fix duplicate W-2 records.

Step 3: Do NOT Refile Regular Forms

Never resend a standard W-3 to “fix” the issue. This will worsen the problem.

How to Fix a Duplicate W-3 Filed Electronically

Can You Cancel a W-3 Filed Electronically?

Many employers ask: “How to cancel a W-3 filed electronically?”

Unfortunately:

- ❌ You cannot cancel or void a W-3 once it’s accepted by the SSA

- ✅ You must correct it using official correction procedures

Amend W-3 After Electronic Filing: The Correct Method

If a duplicate W-3 has already been accepted, you must correct it using W-2c and W-3c forms, depending on how the duplication affected employee wages.

When Is a W-3c Required?

You need a W-3c (Corrected Transmittal of Wage and Tax Statements) if:

- Wages were overreported

- Duplicate totals were transmitted

- SSA shows two W-3 records for the same EIN

This is the official method to correct duplicate W-3 SSA records.

How to Correct Overreported Wages to Social Security

Duplicate W-3 filings often result in overreported wages at the SSA level.

To fix this:

- Prepare W-2c forms for affected employees

- Prepare a W-3c summarizing the corrections

- Ensure corrected totals reflect accurate wages

- File electronically or by mail per SSA guidelines

This process prevents:

- Earnings inflation on employee SSA records

- Future benefit calculation issues

- IRS and SSA mismatch notices

How to Fix Duplicate W-2 Records Caused by W-3 Errors

Many employers worry:

“Will employees get duplicate W-2s if W-3 is filed twice?”

The Answer:

- A duplicate W-3 can cause W-2 mismatches

- Employees may appear to have duplicate wage records

- This can delay tax refunds or cause IRS rejections

How to Prevent Employees From Getting Two W-2s:

- Do not issue replacement W-2s unless required

- Communicate with employees if corrections are pending

- Provide W-2c only when officially completed

Fix Duplicate W-3 Before W-2s Are Issued (Best Case Scenario)

If you catch the error early—before W-2s are distributed—you can:

- Correct payroll data internally

- Submit corrected forms promptly

- Avoid employee confusion altogether

Early detection is the best way to prevent downstream payroll issues.

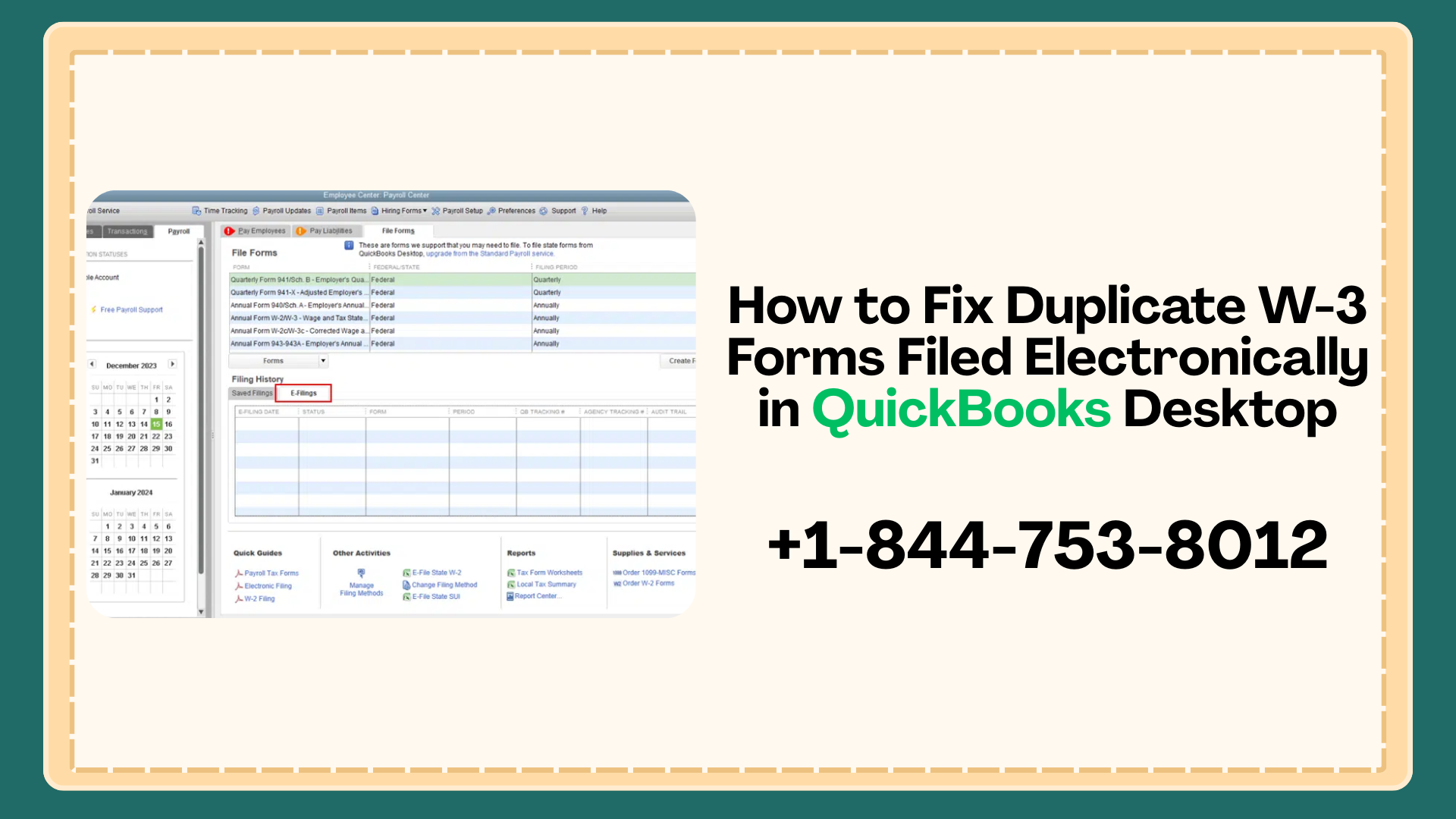

How to Correct a Duplicate W-3 in QuickBooks Desktop

While QuickBooks Desktop does not “delete” submitted forms, it does support corrected filings.

General Steps:

- Open QuickBooks Desktop

- Go to Employees > Payroll Tax Forms & W-2s

- Select Process Payroll Forms

- Choose Corrected Forms (W-2c / W-3c)

- Enter corrected wage totals

- Review carefully

- Submit corrections

⚠️ Accuracy is critical. Incorrect corrections can trigger additional SSA notices.

For help completing this safely, call 844-753-8012.

QuickBooks Payroll Tax Form Rejected or Pending

Sometimes duplicate submissions lead to:

- Payroll tax form rejected

- Filing stuck in pending status

- No confirmation updates

In these cases:

- Do not resubmit blindly

- Verify SSA records

- Address rejection reasons

- Submit corrections—not duplicates

Payroll Form Filing Error Correction: Best Practices

To avoid duplicate W-3 filing issues in the future:

- Always verify SSA confirmation

- Avoid clicking “Submit” multiple times

- Assign one payroll admin

- Keep QuickBooks Desktop updated

- Save confirmation receipts

- File early to allow time for corrections

When to Get Expert Help

You should contact a payroll specialist if:

- SSA sent a notice

- Multiple employees are affected

- You’re unsure how to prepare W-3c

- QuickBooks Desktop status won’t update

- Forms are rejected or stuck pending

Call 844-753-8012 for expert assistance with duplicate W-3 filing correction in QuickBooks Desktop.

Final Thoughts

A duplicate W-3 filed electronically can feel overwhelming, but it’s a fixable payroll issue when handled correctly. Whether you filed W-3 twice by mistake, noticed SSA received duplicate W-3, or are struggling with QuickBooks W-2/W-3 status not updating, the key is to stop refiling and correct the data properly.

Using the correct amendment and correction process protects your business, your employees, and your compliance standing.

For fast, reliable help, call 📞 844-753-8012 and get your QuickBooks payroll back on track.

FAQs: Duplicate W-3 Filing in QuickBooks Desktop

SSA may record duplicate wage totals, which must be corrected using W-3c.

Trust SSA records and do not refile.

You cannot cancel it—only correct it.

They may see wage discrepancies unless corrected properly.

Identify the issue early and submit corrected forms promptly.