Filing payroll forms accurately is critical—especially when corrections are required after submission. If you’ve already filed W-2s through QuickBooks Desktop and later discovered an error, you may be wondering how to e-file W-2C and W-3C in QuickBooks Desktop and stay compliant with SSA requirements.

This guide explains everything you need to know about corrected W-2 QuickBooks Desktop, why e-filing is mandatory in 2024, and how to submit W-2C and W-3C forms correctly—even when QuickBooks only allows printing.

What Are W-2C and W-3C Forms?

-

Form W-2C (Corrected Wage and Tax Statement) is used to correct errors on a previously filed W-2.

-

Form W-3C is the transmittal form summarizing all corrected W-2C forms sent to the SSA.

Common reasons for corrections include:

-

Incorrect wages or taxes

-

Wrong Social Security number or employee name

-

Incorrect employer EIN

-

Benefits or retirement contributions entered incorrectly

If you’re using QuickBooks payroll W-2C, understanding how corrections work is essential.

Also Read: How to Apply a Reconciled Check to Open Invoices in QuickBooks

SSA W-2C E-File Requirement 2024

As of 2024, the SSA requires corrected W-2 forms to be e-filed if you file 10 or more forms. This applies to both original W-2s and corrected W-2C filings.

This means:

-

Corrected W-2 must be e-filed in 2024

-

Paper filing may result in penalties unless you qualify for a waiver

-

Employers must use SSA’s Business Services Online (BSO) portal or approved software

This requirement often causes confusion for QuickBooks users because QuickBooks Desktop print only W-2C functionality does not support direct e-filing.

Can You E-File W-2C and W-3C in QuickBooks Desktop?

Here’s the key limitation you need to know:

❌ QuickBooks Desktop does NOT support e-filing W-2C or W-3C

✅ QuickBooks Desktop allows you to create and print corrected forms only

This leads to a common issue:

QuickBooks Desktop W-2 correction not e-filed

To stay compliant, you must use the SSA’s portal to submit corrections electronically.

How to E-File W-2C and W-3C After E-Filing W-2

Follow these steps carefully to ensure accurate and compliant filing.

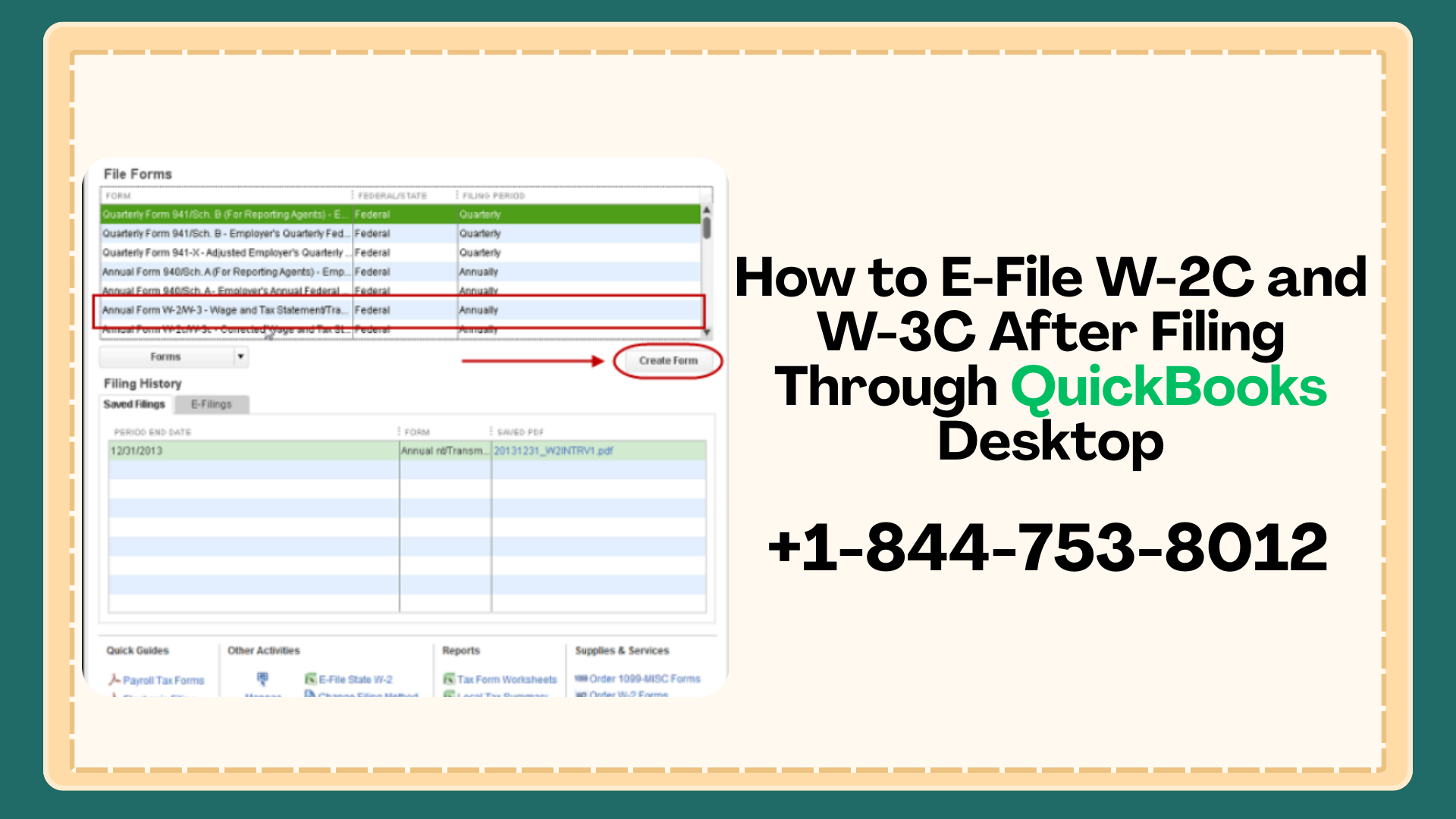

Step 1: Create Corrected W-2 (W-2C) in QuickBooks Desktop

-

Open QuickBooks Desktop

-

Go to Employees → Payroll Tax Forms & W-2s → Process Payroll Forms

-

Select W-2, W-3 Forms

-

Choose Create Form → W-2C/W-3C

-

Select the employee(s) needing correction

-

Enter corrected information and review carefully

This process generates QuickBooks Desktop W-2C and W-3C forms.

Step 2: Print and Review W-2C and W-3C

Since QuickBooks Desktop is print-only for corrections:

-

Print Copy A (SSA)

-

Print Copy B & C (Employee copies)

-

Review all corrected fields carefully

This step confirms accuracy before electronic submission.

Also Read: Vendors and 1099 Data Appearing in the Wrong QBO Company: A Cross-Company Bank Feed Issue

Step 3: Set Up SSA Business Services Online (BSO)

To e-file corrected W-2 SSA QuickBooks, you must use SSA BSO.

-

Visit SSA Business Services Online

-

Register or log in

-

Ensure your EIN and business details match QuickBooks

This portal is required for QuickBooks Desktop W-2C SSA BSO filing.

Step 4: Manually E-File W-2C and W-3C Through SSA

QuickBooks does not transmit corrections automatically, so you must:

-

Log in to SSA BSO

-

Choose W-2C/W-3C Online

-

Manually enter corrected data from your printed W-2C forms

-

Submit electronically

-

Save confirmation receipts

This completes the e-file W-2C W-3C QuickBooks Desktop workaround.

Common Problems and How to Fix Them

QuickBooks W-3C E-File Issue

Cause: QuickBooks doesn’t support electronic submission

Fix: File W-3C manually via SSA BSO

QuickBooks Desktop Print Only W-2C

Cause: Software limitation

Fix: Use printed forms as reference for SSA e-filing

Corrected W-2 Not Accepted by SSA

Cause: Mismatch between original and corrected data

Fix: Ensure only corrected fields are changed—not entire form

Best Practices for W-2C Filing

-

Do not refile original W-2s

-

Only correct fields with errors

-

Keep copies of SSA submission confirmations

-

Notify employees promptly of corrections

-

File corrections as soon as errors are discovered

These steps help prevent penalties and payroll compliance issues.

QuickBooks Desktop vs Online for W-2C Filing

| Feature | QuickBooks Desktop | QuickBooks Online |

|---|---|---|

| Original W-2 E-File | Yes | Yes |

| W-2C Creation | Yes | Limited |

| W-2C E-File | No | No |

| SSA Manual Filing Required | Yes | Yes |

Regardless of version, SSA manual e-filing is required for corrections.

When to Get Expert Help

You should contact payroll experts if:

-

You have multiple corrected employees

-

SSA rejects your submission

-

You’re unsure about 2024 compliance rules

-

You want to avoid penalties

📞 Call 844-753-8012 for professional assistance with:

-

QuickBooks payroll W-2C

-

Corrected W-2 must be e-filed 2024

-

QuickBooks Desktop W-2C SSA BSO

-

QuickBooks W-3C e-file issues

Conclusion

If you’ve already filed W-2s and need to make corrections, understanding how to e-file W-2C and W-3C after e-filing W-2 is essential—especially with the SSA W-2C e-file requirement for 2024.

While QuickBooks Desktop allows you to create corrected forms, electronic submission must be completed manually through SSA BSO. With the right steps—and expert help when needed—you can stay compliant and avoid costly penalties.

For reliable support, call 844-753-8012 and get your W-2C and W-3C filed correctly and on time.

FAQ: E-File W-2C and W-3C After Filing Through QuickBooks Desktop

No. QuickBooks Desktop does not support e-filing W-2C or W-3C. The software only allows you to create and print corrected forms. You must e-file corrections manually through the SSA Business Services Online (BSO) portal.

This is a system limitation. While QuickBooks Desktop supports original W-2 e-filing, QuickBooks Desktop print only W-2C functionality means corrected forms must be submitted electronically outside of QuickBooks.

Yes. Under the SSA W-2C e-file requirement 2024, employers filing 10 or more forms must e-file corrected W-2s. Paper filing is only allowed if you qualify for an SSA waiver.

To e-file corrected W-2 SSA QuickBooks forms:

1. Create W-2C/W-3C in QuickBooks Desktop

2. Print and review the forms

3. Log in to SSA Business Services Online (BSO)

4. Manually enter the corrected information

5. Submit electronically and save confirmation

Form W-3C summarizes all W-2C corrections being submitted. When e-filing W-2C forms, W-3C must also be filed electronically through SSA BSO.

The issue occurs because QuickBooks Desktop does not transmit corrected forms electronically. This is not an error—manual SSA submission is required to complete compliance.

You can correct:

1. Employee name or SSN

2. Wage and tax amounts

3. Employer EIN

4. Retirement contributions

5. Benefit reporting errors

These corrections are handled through QuickBooks payroll W-2C creation.

No. W-2C forms only correct specific fields. They do not replace or resubmit the original W-2 but update SSA records with corrected information.

Failure to comply with the corrected W-2 must be e-filed 2024 rule may result in:

1. IRS or SSA penalties

2. Rejected filings

3. Compliance audits

If you’re facing issues with:

1. QuickBooks Desktop W-2C SSA BSO

2. QuickBooks Desktop W-2 correction not e-filed

3. SSA rejection errors

Call 844-753-8012 for expert assistance to ensure accurate and compliant W-2C and W-3C filing.