Managing taxes as a self-employed individual can be challenging—especially when you need to find old tax data in QuickBooks Self-Employed (QBSE). Whether you’re filing an amended return, preparing for an audit, or simply asking “How do I see last year in QuickBooks Self-Employed?”, accessing prior-year records is essential.

QuickBooks Self-Employed is designed to track income, expenses, mileage, and estimated taxes year-round. But many users don’t realize how easy it is to pull prior year reports in QBSE, export tax summaries, and retrieve Schedule C information.

In this guide, we’ll walk you step-by-step through how to access previous years in QuickBooks Self-Employed, including 2024 taxes, tax reports, and downloadable summaries. If you need hands-on help at any point, you can also call 844-753-8012 for assistance.

Why You May Need QuickBooks Self-Employed Previous Year Data

There are many reasons users look for QuickBooks Self-Employed previous tax year information, including:

- Filing late or amended tax returns

- Verifying income and expenses

- Preparing documents for lenders or audits

- Comparing year-over-year business performance

- Downloading Schedule C reports

- Exporting tax data for accountants

If you’ve ever wondered “Can I go back to previous years in QuickBooks Self-Employed?”—the answer is yes, and the process is simpler than you might think.

Also Read: How to Fix Duplicate W-2 Forms Filed Electronically in QuickBooks Desktop

Can You Access Previous Years in QuickBooks Self-Employed?

Yes. QuickBooks Self-Employed stores your historical financial data as long as your account remains active. You can easily retrieve:

- Old income and expenses

- Mileage logs

- Tax summaries

- Schedule C reports

- Prior-year tax estimates

This makes it easy to retrieve old income and expenses in QBSE and stay compliant with IRS requirements.

How Do I See Last Year in QuickBooks Self-Employed?

One of the most common questions is:

“How do I see last year in QuickBooks Self-Employed?”

Follow these steps:

Step 1: Sign in to QuickBooks Self-Employed

Log in using your credentials at the QuickBooks Self-Employed dashboard.

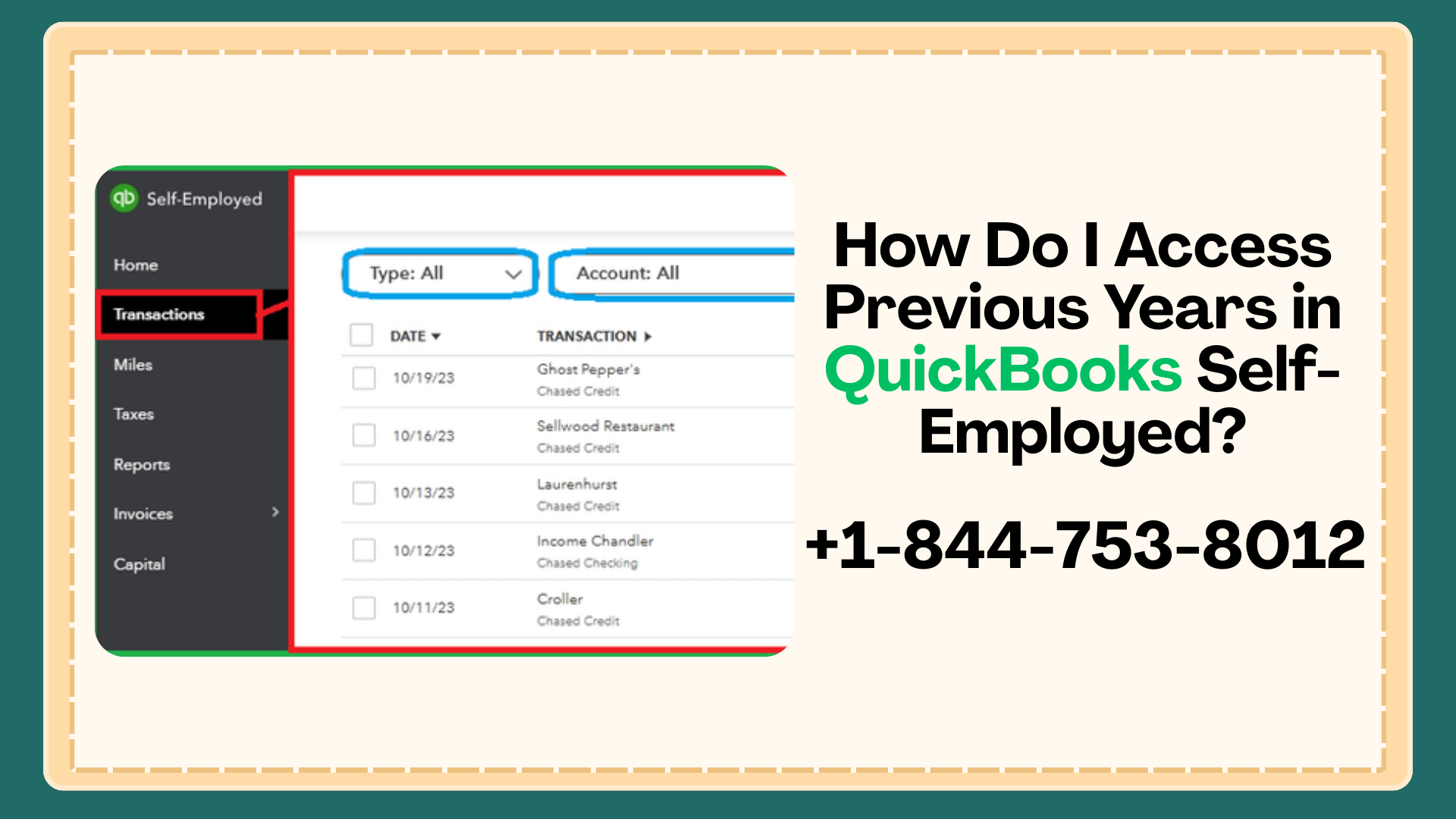

Step 2: Navigate to the Reports or Taxes Menu

From the left-hand menu, click on Reports or Taxes depending on what data you need.

Step 3: Select the Correct Tax Year

Use the drop-down menu to change the year. This allows you to view QuickBooks Self-Employed previous year data instantly.

Also Read: How to Fix a Duplicate W-3 Filed Electronically in QuickBooks Desktop

Where Is Prior Year Tax Info in QBSE?

If you’re asking, “Where is prior year tax info in QBSE?”, here’s where to look:

- Taxes Tab – For quarterly estimates and annual summaries

- Reports Tab – For profit & loss, tax summaries, and Schedule C

- Transactions Tab – To find old income and expense entries

Each section allows you to filter by year, helping you find old tax data in QuickBooks Self-Employed with precision.

How to Get 2024 Tax Report from QuickBooks Self-Employed

Many users specifically search for QuickBooks Self-Employed 2024 taxes or ask “How to get 2024 tax report from QuickBooks Self-Employed?”

Here’s how:

- Go to Reports

- Select Tax Summary Report

- Choose 2024 from the year filter

- Review income, expenses, and deductions

This QuickBooks Self-Employed tax summary report is essential for accurate tax filing.

QuickBooks Self-Employed Tax Reports You Can Access

QBSE offers several valuable reports for current and prior years, including:

1. Tax Summary Report

Shows totals for income, expenses, and deductions—perfect for annual filing.

2. Schedule C Report

The QuickBooks Self-Employed Schedule C report mirrors IRS Schedule C categories, making it easier to file taxes with QB Self-Employed or hand off to a tax professional.

3. Profit and Loss Report

Helpful for business analysis and loan applications.

4. Mileage Reports

Available for previous years if mileage tracking was enabled.

These reports make it easy to pull prior year reports from QBSE in just a few clicks.

How to Download Old Tax Summary from QB Self-Employed

Need a downloadable copy for your records or accountant? Here’s how to download old tax summary from QB Self-Employed:

- Open Reports

- Select Tax Summary

- Choose the desired year

- Click Export

- Download as PDF or Excel

This lets you export tax data from QuickBooks Self-Employed quickly and securely.

How to File Taxes with QB Self-Employed Using Prior Year Data

If you’re wondering how to file taxes with QB Self-Employed using old data, QBSE simplifies the process by organizing everything by tax year.

You can:

- Review prior-year income and expenses

- Verify deductions

- Access Schedule C totals

- Export reports for TurboTax or your accountant

This streamlined workflow helps avoid errors and ensures accurate filing.

Can I Go Back to Previous Years in QuickBooks Self-Employed?

Another common question is:

“Can I go back to previous years in QuickBooks Self-Employed?”

Yes—QBSE allows access to prior years as long as:

- Your account remains active

- Data hasn’t been manually deleted

- You’re using the same login

You can go back multiple years to retrieve reports, transactions, and tax summaries.

Troubleshooting: Can’t Find Old Tax Data?

If you’re unable to find old tax data in QuickBooks Self-Employed, try the following:

- Confirm the correct year is selected

- Check both Reports and Taxes tabs

- Ensure transactions were categorized correctly

- Verify you’re logged into the right account

Still stuck? Call 844-753-8012 for expert help accessing your QBSE records.

Benefits of Keeping Prior Year Records in QBSE

Accessing QuickBooks Self-Employed previous tax year data helps you:

- Stay IRS-compliant

- Respond to audits quickly

- Track business growth

- Plan future tax payments

- Avoid re-entering old data

QuickBooks Self-Employed is built to keep your financial history organized and accessible.

Final Thoughts

Accessing previous years in QuickBooks Self-Employed doesn’t have to be confusing. Whether you need QuickBooks Self-Employed tax reports, want to retrieve old income and expenses in QBSE, or are preparing your QuickBooks Self-Employed Schedule C report, the platform gives you full control over your historical data.

If you need help navigating reports, exporting files, or locating prior-year tax info, don’t hesitate to call 844-753-8012 for personalized support.

Staying organized today makes tax filing easier tomorrow—and QuickBooks Self-Employed gives you the tools to do just that.

Frequently Asked Questions (FAQs)

Go to Reports or Taxes and select the previous year from the drop-down menu.

You can find it under Reports, Taxes, and Transactions, filtered by year.

Open Tax Summary Report, select 2024, and export if needed.

Yes, use the Export option to download PDF or Excel versions.