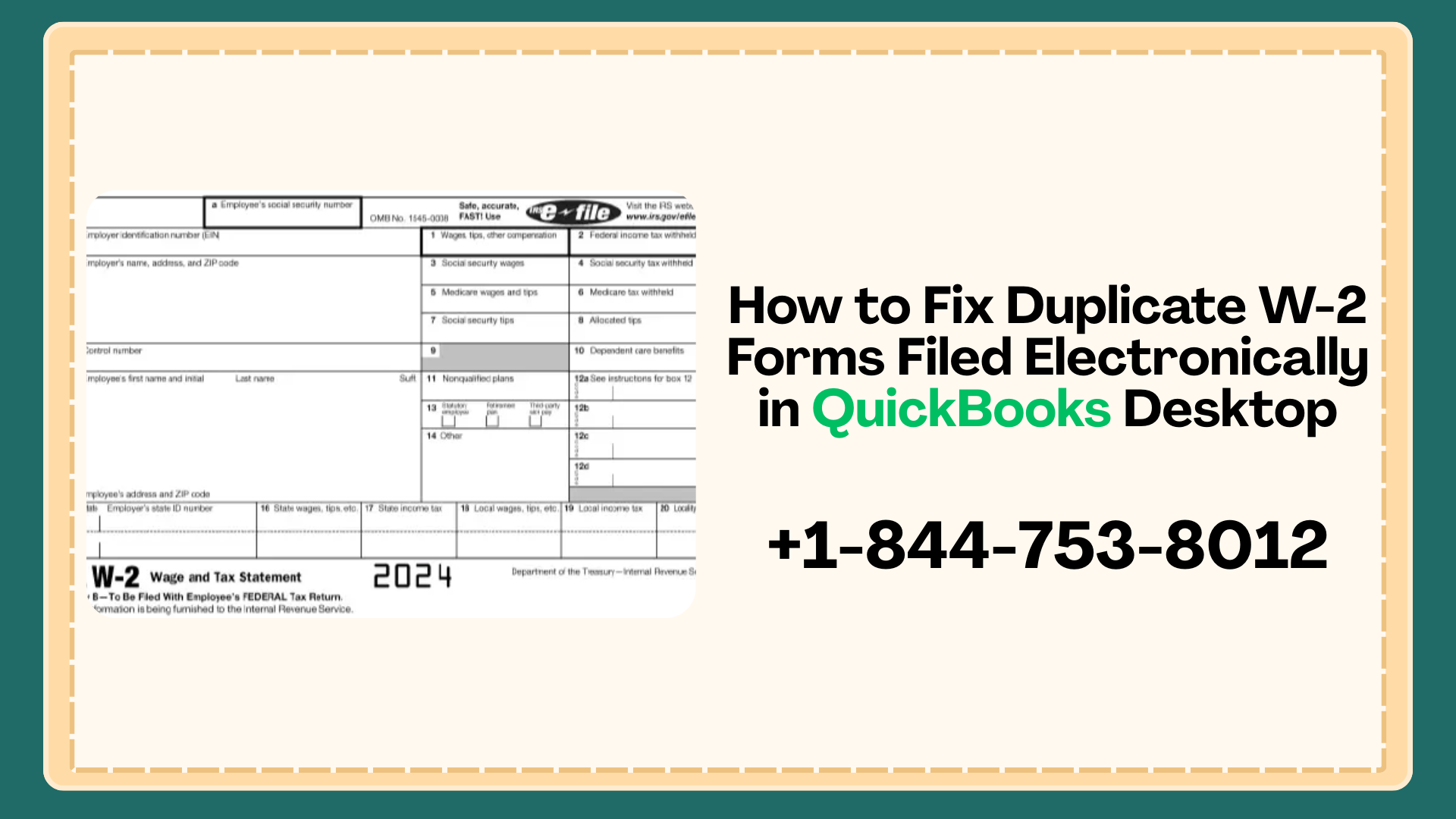

Filing payroll forms is stressful enough—but realizing you filed a W-2 twice by mistake can send any business owner into panic mode. If you’re seeing messages like “SSA received duplicate W-2”, “Employee showing two W-2 forms”, or “QuickBooks W-2 status not updating”, don’t worry. You’re not alone—and this issue can be fixed correctly.

In this guide, we’ll walk you through the duplicate W-2 filing correction process, explain what happens if you file a W-2 twice by mistake, and show how to correct duplicate W-2 forms filed electronically in QuickBooks Desktop without creating payroll or tax penalties.

If at any point you want expert help, call 📞 844-753-8012 for QuickBooks payroll W-2 correction support.

What Is a Duplicate W-2 Filed Electronically?

A duplicate W-2 filed electronically occurs when the same employee’s W-2 is submitted more than once to the Social Security Administration (SSA). This often happens when:

- You re-submit W-2s because QuickBooks shows “Submitted” but not “Accepted”

- You clicked Send twice during electronic filing

- QuickBooks Desktop froze or timed out during submission

- You attempted to refile after a transmission error

- W-2s were filed again after payroll corrections

The SSA may then flag the record as W-2 submitted twice electronically, which can lead to overreported wages and confusion for both you and your employee.

What Happens If I File a W-2 Twice by Mistake?

This is one of the most common questions employers ask—and understandably so.

If you filed W-2 twice by mistake, here’s what can happen:

- The SSA receives duplicate W-2 data

- Employee wages appear overreported

- The employee may receive two W-2 forms

- The SSA may issue a notice or mismatch letter

- Employees may have trouble filing personal tax returns

- Corrections (W-2c and W-3c) may be required

The good news? Duplicate W-2 filing does not automatically mean penalties, as long as it’s corrected properly and promptly.

Also Read: How to Convert QuickBooks 2009 Files to the Latest Version – Complete Upgrade & Data Migration Guide

Common Reasons Duplicate W-2 Forms Occur in QuickBooks Desktop

Understanding the cause helps determine the correct fix.

1. QuickBooks W-2 Status Not Updating

Many users see:

- SSA says received but QuickBooks says submitted

This mismatch leads users to refile, resulting in a duplicate W-2 filed electronically.

2. Filing W-2 Twice Due to System Lag

QuickBooks Desktop may appear frozen during submission. Users exit and resend, not realizing the first submission already went through.

3. Payroll Amendments After Filing

Making payroll changes and then re-filing W-2s without using W-2c can cause duplicate W-2 overreporting to Social Security.

4. Multiple Admin Users

If more than one admin submits forms, W-2s may be submitted twice electronically.

How to Check If SSA Received a Duplicate W-2

Before taking action, confirm the issue.

Step 1: Log in to SSA Business Services Online (BSO)

- Check filing status

- Look for duplicate entries for the same EIN and employee

Step 2: Compare Submission Dates

If two W-2s show the same wages and year, the SSA likely received a duplicate.

Step 3: Verify Employee Records

If the employee received two W-2 forms, that’s a strong indicator of duplicate filing.

How to Fix Duplicate W-2 Filed Electronically in QuickBooks Desktop

Step 1: Do NOT Void Payroll Checks

Voiding payroll checks does not fix a duplicate W-2 filed with the SSA.

Step 2: Determine If a W-2c Is Required

If:

- SSA received duplicate W-2

- Wages are overreported

- Employee has two W-2s on record

You must file a W-2c (Corrected Wage and Tax Statement).

Correct Duplicate W-2 SSA Filing Using W-2c and W-3c

What Is W-2c?

A W-2c corrects wage, tax, or duplicate reporting errors.

What Is W-3c?

A W-3c is the transmittal form required when correcting W-2s.

This is the official W-3 duplicate filing correction process recognized by the SSA.

How to Create a W-2c in QuickBooks Desktop

- Open QuickBooks Desktop

- Go to Employees > Payroll Tax Forms & W-2s

- Select Process Payroll Forms

- Choose File Forms

- Select Corrected Forms (W-2c/W-3c)

- Enter correct wage amounts (usually zero difference if duplicate)

- Review carefully

- E-file the corrected forms

⚠️ Important: Do not guess values. Incorrect W-2c entries can worsen overreporting issues.

If you want help, call 844-753-8012 to ensure your QuickBooks payroll W-2 correction is done right the first time.

Also Read: Can’t Find Profit and Loss Report in QuickBooks? Here’s the Fix

How to Void a Duplicate W-2 (When Applicable)

Many people ask: “How to cancel a W-2 filed electronically?”

Here’s the truth:

- ❌ You cannot cancel or void a W-2 once it’s accepted by the SSA

- ✅ You must correct it using W-2c

Voiding only applies before submission, not after acceptance.

Amend W-2 After Electronic Filing: Best Practices

If you need to amend W-2 after electronic filing, follow these rules:

- Never refile a regular W-2 to fix an error

- Always use W-2c for corrections

- Match corrected data exactly

- File promptly to avoid SSA notices

What If an Employee Received Two W-2 Forms?

This is a sensitive situation.

What to Do:

- Explain that a duplicate W-2 was filed electronically

- Confirm which W-2 is valid

- Ask the employee not to file taxes yet

- Provide the corrected W-2c once available

This prevents IRS mismatches and refund delays.

Fix Payroll Tax Form Filing Error in QuickBooks Desktop

To avoid future duplicate W-2 filing issues:

- Wait for SSA confirmation, not just QuickBooks status

- Avoid clicking “Send” more than once

- Use one admin for payroll filings

- Keep QuickBooks Desktop updated

- Save confirmation receipts

When to Call a Payroll Expert

You should seek help if:

- SSA sent a notice

- Multiple employees are affected

- You’re unsure how to complete W-2c

- QuickBooks Desktop errors persist

- W-2 status is not updating

📞 Call 844-753-8012 for expert help with duplicate W-2 filing correction in QuickBooks Desktop.

Final Thoughts

A duplicate W-2 filed electronically can feel overwhelming, but it’s a fixable payroll issue. Whether you’re dealing with W-2 submitted twice electronically, SSA received duplicate W-2, or employee showing two W-2 forms, the key is not to refile blindly.

Follow the proper duplicate W-2 filing correction process, use W-2c and W-3c, and get expert help when needed.

For fast, accurate assistance, call 📞 844-753-8012 today and get your QuickBooks payroll back on track.

FAQ: Duplicate W-2 Filing Correction Process

SSA confirmation overrides QuickBooks status. Do not refile. Verify in SSA BSO first.

File W-2c and W-3c correcting the duplicate wages.

Usually no—if corrected promptly and accurately.

You can’t cancel it after submission. You must correct it.